Schedule 14A Information

Proxy Statement Pursuant to Section 14(A) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement [ ] Confidential, for Use of the Commission

[X] Definitive Proxy Statement Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Additional Materials

[ ] Soliciting Material under Section 240.14a-12

Templeton Emerging Markets Fund

(Name of Registrant as Specified in its Charter)

Name of Person(s) Filing Proxy Statement, other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

TEMPLETON EMERGING MARKETS FUND

IMPORTANT SHAREHOLDER INFORMATION

These materials are for the Annual Meeting of Shareholders (the “Meeting”) scheduled for March 2, 2020,8, 2021, at 12 Noon, Eastern time. The enclosed materials discuss the proposals (the “Proposals” or each, a “Proposal”) to be voted on at the Meeting, and contain the Notice of Meeting, proxy statement and proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on important issues relating to Templeton Emerging Markets Fund (the “Fund”). If you specify a vote on a Proposal, your proxy will be voted as you indicate. If you specify a vote on a Proposal,one or more Proposals, but not all Proposals, your proxy will be voted as specified on such ProposalProposal(s) and, on the ProposalProposal(s) for which no vote is specified, your proxy will be voted FOR such Proposal.Proposal(s). If you simply sign, date and return the proxy card, but do not specify a vote on any Proposal, your proxy will be voted FOR the Proposals.

We urge you to spend a few minutes reviewing the Proposals in the proxy statement. Then, please fill out and sign the proxy card and return it to us so that we know how you would like to vote. When shareholders return their proxies promptly, the Fund may be able to save money by not having to conduct additional mailings.

In light of the COVID-19 pandemic, we are urging all shareholders to take advantage of voting by mail, Internet or telephone (separate instructions are listed on the enclosed proxy card to vote by telephone or through the Internet). Additionally, while we anticipate that the Meeting will occur as planned on March 8, 2021, there is a possibility that, due to the COVID-19 pandemic, the Meeting may be postponed or the location or approach may need to be changed, including the possibility of holding a virtual meeting for the health and safety of all Meeting participants. Should this occur, we will notify you by issuing a press release and filing an announcement with the U.S. Securities and Exchange Commission as definitive additional soliciting material. If you plan to attend the Meeting in person, please note that we will be holding the Meeting in accordance with any recommended and required social distancing and safety guidelines, as applicable.

We welcome your comments. If you have any questions, call Fund Information at (800) DIAL BEN®/342-5236.

TELEPHONE AND INTERNET VOTING

For your convenience, you may be able to vote by telephone or through the Internet, 24 hours a day. If your account is eligible, instructions are enclosed.

TEMPLETON EMERGING MARKETS FUND

NOTICE OF 20202021 ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders (the “Meeting”) of Templeton Emerging Markets Fund (the “Fund”) will be held at the Fund’s offices, 300 S.E. 2nd Street, Fort Lauderdale, Florida 33301-1923 on March 2, 2020,8, 2021, at 12 Noon, Eastern time.

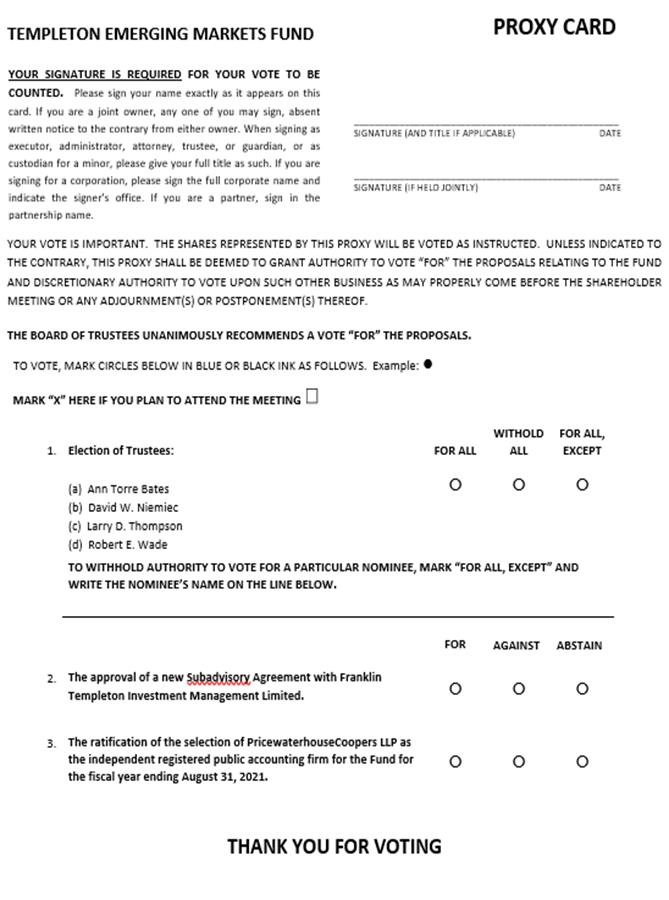

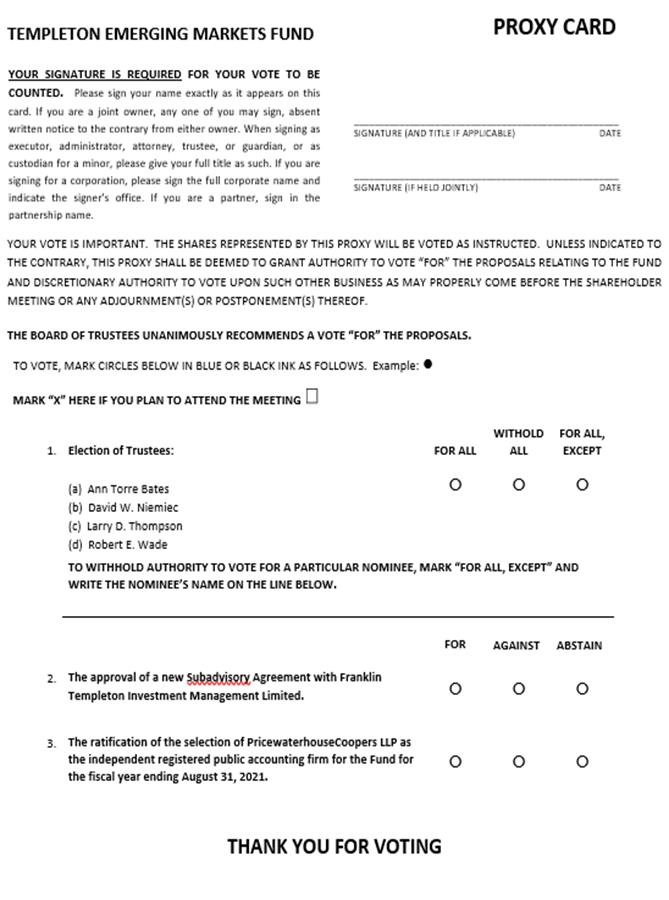

During the Meeting, shareholders of the Fund will vote on the following Proposals:

1.The election of four Trustees of the Fund to hold office for the terms specified.

2.The approval of a new Subadvisory Agreement with Franklin Templeton Investment Management Limited.

3.The ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund for the fiscal year ending August 31, 2020.2021.

By Order of the Board of Trustees,

Lori A. Weber

Vice President and Secretary

January 2, 20207, 2021

Please sign and promptly return the proxy card or voting instruction form in the enclosed self-addressed envelope regardless of the number of shares you own. If you have any questions, call Fund Information at (800) DIAL BEN®/342-5236.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING TO BE HELD ON MARCH 2, 20208, 2021

The Fund’s Notice of Annual Meeting of Shareholders, Proxy Statement and form of Proxy are available on the Internet at https://vote.proxyonline.com/franklintempleton/franklin/docs/emf2020.pdf.emf2021.pdf. The form of Proxy on the Internet site cannot be used to cast your vote.

TEMPLETON EMERGING MARKETS FUNDPROXY STATEMENT

◆INFORMATION ABOUT VOTING

Who is asking for my vote?

The Board of Trustees of Templeton Emerging Markets Fund (the “Fund”), in connection with the Fund’s Annual Meeting of Shareholders (the “Meeting”), has requested your vote.

Who is eligible to vote?

Shareholders of record at the close of business on December 16, 2019,14, 2020, are entitled to be present and to vote at the Meeting or any adjourned Meeting. Each share of record is entitled to one vote (and a proportionate fractional vote for each fractional share) on each matter presented at the Meeting. The Notice of Meeting, the proxy statement, and the proxy card were first mailed to shareholders of record on or about January 2, 2020.7, 2021.

On what issues am I being asked to vote?

You are being asked to vote on twothree Proposals:

1.The election of four Trustees of the Fund;

2.The approval of a new Subadvisory Agreement with Franklin Templeton Investment Management Limited (“FTIML”); and

2. 3.The ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund for the fiscal year ending August 31, 2020.2021.

How do the Fund’s Trustees recommend that I vote?

The Trustees unanimously recommend that you vote vote:

1. FOR the election of four Trustees of the four nominees for Trustee and Fund.

2. FOR the approval of a new Subadvisory Agreement with FTIML.

3. FOR the ratification of the selection of PricewaterhouseCoopers LLP (“PwC”) as the independent registered public accounting firm for the Fund for the fiscal year ending August 31, 2020.2021.

How do I ensure that my vote is accurately recorded?

You may attend the Meeting and vote in personin-person or you may complete and return the enclosed proxy card. If you are eligible to vote by telephone or through the Internet, instructions are enclosed. Proxy cards that are properly signed, dated and received at or prior to the Meeting will be voted as specified. If you specify a vote on any of theall Proposals, your proxy will be voted as you indicate. If you specify a vote on one or more Proposals, but not all, your proxy will be voted as specified on such Proposal(s) and, on the Proposal(s) for which no vote is specified, your proxy will be voted “FOR” the Proposal(s). If you simply sign, date and return the proxy card, but do not specify a vote on eitherany Proposal, 1 or 2, your sharesproxy will be voted FOR the election of all nominees for Trustee and FOR the ratification of the selection of PwC as the independent registered public accounting firm for the Fund for the fiscal year ending August 31, 2020.“FOR” each Proposal.

May I revoke my proxy?

You may revoke your proxy at any time before it is voted by forwarding a written revocation or a later-dated proxy to the Fund that is received by the Fund at or prior to the Meeting, or by attending the Meeting and voting in person.

What if my shares are held in a brokerage account?

If your shares are held by your broker, then in order to vote in person at the Meeting, you will need to obtain a “Legal Proxy” from your broker and present it to the Inspector of Election at the Meeting. Also, in order to revoke your proxy, you may need to forward your written revocation or a later-dated proxy card or voting instruction form to your broker rather than to the Fund.

May I attend the Meeting in Person?

Shareholders of record at the close of business on December 16, 201914, 2020 are entitled to attend the Meeting. Eligible shareholders who intend to attend the Meeting in person will need to bring proof of share ownership, such as a shareholder statement or a letter from a custodian or broker-dealer confirming ownership, as of December 16, 201914, 2020 and a valid picture identification, such as a driver’s license or passport, for admission to the Meeting. Seating is limited. Shareholders without proof of ownership and identification will not be admitted.

In light of the COVID-19 pandemic, we are urging all shareholders to take advantage of voting by mail, Internet or telephone (separate instructions are listed on the enclosed proxy card to vote by telephone or through the Internet). Additionally, while we anticipate that the Meeting will occur as planned on March 8, 2021, there is a possibility that, due to the COVID-19 pandemic, the Meeting may be postponed or the location or approach may need to be changed, including the possibility of holding a virtual meeting for the health and safety of all Meeting participants. Should this occur, we will notify you by issuing a press release and filing an announcement with the U.S Securities and Exchange Commission (“SEC”) as definitive additional soliciting material. If you plan to attend the Meeting in person, please note that we will be holding the Meeting in accordance with any recommended and required social distancing and safety guidelines, as applicable.

◆THE PROPOSALS

PROPOSAL 1: ELECTION OF TRUSTEES

How are nominees selected?

The Board of Trustees of the Fund (the “Board” or the “Trustees”) has a nominating committee (the “Nominating Committee”) consisting of Edith E. Holiday (Chairperson), J. Michael Luttig and Larry D. Thompson, none of whom is an “interested person” of the Fund as defined by the Investment Company Act of 1940, as amended (the “1940 Act”). Trustees who are not interested persons of the Fund are referred to as the “Independent Trustees,” and Trustees who are interested persons of the Fund are referred to as the “Interested Trustees.”

The Nominating Committee is responsible for selecting candidates to serve as Trustees and recommending such candidates (a) for selection and nomination as Independent Trustees by the incumbent Independent Trustees and the full Board; and (b) for selection and nomination as Interested Trustees by the full Board. In considering a candidate’s qualifications, the Nominating Committee generally considers the potential candidate’s educational background, business or professional experience, and reputation. In addition, the Nominating Committee has established as minimum qualifications for Board membership as an Independent Trustee: (1) that such candidate be independent from relationships with the Fund’s investment manager and other principal service providers both within the terms and the spirit of the statutory independence requirements specified under the 1940 Act and the rules thereunder; (2) that such candidate demonstrate an ability and willingness to make the considerable time commitment, including personal attendance at Board meetings, believed necessary to his or her function as an effective Board member; and (3) that such candidate have no continuing relationship as a director, officer or board member of any U.S. registered investment company other than those within the Franklin Templeton fund complex or a closed-end business development company primarily investing in non-public entities. The Nominating Committee has not adopted any specific policy on the issue of diversity, but will take this into account, among other factors, in its consideration of new candidates to the Board.

When the Board has or expects to have a vacancy, the Nominating Committee receives and reviews information on individuals qualified to be recommended to the full Board as nominees for election as Trustees, including any recommendations by “Qualifying Fund Shareholders” (as defined below). Such individuals are

evaluated based upon the criteria described above. To date, the Nominating Committee has been able to identify, and expects to continue to be able to identify, from its own resources an ample number of qualified candidates. The Nominating Committee, however, will review recommendations from Qualifying Fund Shareholders to fill vacancies on the Board if these recommendations are submitted in writing and addressed to the Nominating Committee at the Fund’s offices and are presented with appropriate background material concerning the candidate that demonstrates his or her ability to serve as a Trustee, including as an Independent Trustee, of the Fund. A Qualifying Fund Shareholder is a shareholder who (i) has continuously owned of record, or beneficially through a financial intermediary, shares of the Fund having a net asset value of not less than two hundred fifty thousand dollars ($250,000) during the twenty-four month period prior to submitting the recommendation; and (ii) provides a written notice to the Nominating Committee containing the following information: (a) the name and address of the Qualifying Fund Shareholder making the recommendation; (b) the number of shares of the Fund which are owned of record and beneficially by the Qualifying Fund Shareholder and the length of time that the shares have been owned by the Qualifying Fund Shareholder; (c) a description of all arrangements and understandings between the Qualifying Fund Shareholder and any other person or persons (naming such person or persons) pursuant to which the recommendation is being made; (d) the name, age, date of birth, business address and residence address of the person or persons being recommended; (e) such other information regarding each person recommended by the Qualifying Fund Shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the U.S. Securities and Exchange Commission (“SEC”)SEC had the nominee been nominated by the Board; (f) whether the Qualifying Fund Shareholder making the recommendation believes the person recommended would or would not be an “interested person” of the Fund, as defined in the 1940 Act; and (g) the written consent of each person recommended to serve as a Trustee of the Fund if so nominated and elected/appointed.

The Nominating Committee may amend these procedures from time to time, including the procedures relating to the evaluation of nominees and the process for submitting recommendations to the Nominating Committee.

The Board has adopted and approved a formal written charter for the Nominating Committee. A copy of the charter is attached as Exhibit A to this proxy statement.

Who are the nominees and Trustees?

The Board is divided into three classes. Each class has a term of three years. Each year, the term of office of one class expires. This year, the terms of four Trustees expire: Harris J. Ashton, Mary C. Choksi, EdithAnn Torre Bates, David W. Niemiec, Larry D. Thompson and Robert E. Holiday and J. Michael Luttig.Wade. These individuals have been nominated for three-year terms, set to expire at the 20232024 Annual Meeting of Shareholders. These terms continue, however, until their successors are duly elected and qualified. All of the nominees are currently members of the Board and deemed to be Independent Trustees. In addition, all of the current nominees and Trustees are also directors or trustees of other investment companies within the Franklin Templeton fund complex.

Interested Trustees of the Fund hold director and/or officer positions with, or are principal stockholders of, Franklin Resources, Inc. (“Resources”) and its affiliates. Resources is a publicly owned holding company, a principal stockholder of which is Rupert H. Johnson, Jr., who beneficially owned approximately 21% of its outstanding shares as of August 31, 2019.2020. The shares deemed to be beneficially owned by Rupert H. Johnson, Jr. include certain shares held by a private charitable foundation or by his spouse, of which he disclaims beneficial ownership. Resources, a global investment management organization operating as Franklin Templeton, is

primarily engaged, through various subsidiaries, in providing investment management, share distribution, transfer agent and administrative services to a family of investment companies. Resources is a New York Stock Exchange (“NYSE”) listed holding company (NYSE: BEN). Rupert H. Johnson, Jr., Chairman of the Board, Trustee and Vice President of the Fund, is the uncle of Gregory E. Johnson, a Trustee of the Fund. There are no other family relationships among the Trustees or nominees for Trustee.

Each nominee currently is available and has consented to serve if elected. If any of the nominees should become unavailable, the designated proxy holders will vote in their discretion for another person or persons who may be nominated to serve as Trustees.

In addition to personal qualities, such as integrity, in considering candidates for the Fund Board, the Nominating Committee seeks to find persons of good reputation whose experience and background evidence that such person has the ability to comprehend, discuss and critically analyze materials and issues presented, in exercising judgments and reaching informed conclusions relevant to fulfillment of a Fund Trustee’s duties and fiduciary obligations. Information on the business activities of the nominees and other Trustees during the past five years and beyond appears below and it is believed that the specific background of each Trustee evidences such ability and is appropriate to his or her serving on the Fund’s Board. As indicated, Harris J. Ashton has served as a chief executive officer of NYSE listed public corporations; Larry D. Thompson and Edith E. Holiday each have legal backgrounds, including high level legal positions with departments of the U.S. Government; David W. Niemiec has served as a chief financial officer of a major corporation; Ann Torre Bates has served as a chief financial officer of a major corporation and as a board member of a number of public companies; J. Michael Luttig has fifteen years of judicial experience as a Federal Appeals Court Judge and thirteen years of experience as Executive Vice President and General Counsel of a major public company; Robert E. Wade has had more than thirty years’ experience as a solo practicing attorney; Constantine D. Tseretopoulos has professional and executive experience as founder and Chief of Staff of a hospital; Mary C. Choksi has an extensive background in asset management, including founding an investment management firm; and Rupert H. Johnson, Jr. and Gregory E. Johnson are both high ranking executive officers of Resources.

Listed below with the business activities of the nominees and Trustees are their names and years of birth, their positions and length of service with the Fund and the number of portfolios in the Franklin Templeton fund complex that they oversee.

Nominees for Independent Trustee to serve until 2024 Annual Meeting of Shareholders: |

Name, Year of Birth and Address | Position | Length of

Time Served | Number of

Portfolios in

Franklin

Templeton

Fund Complex

Overseen

by Trustee* | Other Directorships Held During

at Least the Past Five Years |

Ann Torre Bates (1958)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 2008 | 30 | Ares Capital Corporation (specialty finance company) (2010-present), United Natural Foods, Inc. (distributor of natural, organic and specialty foods) (2013-present), formerly, Allied Capital Corporation (financial services) (2003-2010), SLM Corporation (Sallie Mae) (1997-2014) and Navient Corporation (loan management, servicing and asset recovery) (2014-2016). |

|

Principal Occupation During at Least the Past 5 Years: |

Director of various companies; and formerly, Executive Vice President and Chief Financial Officer, NHP Incorporated (manager of multifamily housing) (1995-1997); and Vice President and Treasurer, US Airways, Inc. (until 1995). |

David W. Niemiec (1949)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 2005 | 30 | Hess Midstream LP (oil and gas midstream infrastructure) (2017-present). |

|

Principal Occupation During at Least the Past 5 Years: |

Advisor, Saratoga Partners (private equity fund); and formerly, Managing Director, Saratoga Partners (1998-2001) and SBC Warburg Dillon Read (investment banking) (1997-1998); Vice Chairman, Dillon, Read & Co. Inc. (investment banking) (1991-1997); and Chief Financial Officer, Dillon, Read & Co. Inc. (1982-1997). |

Larry D. Thompson (1945)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 2005 | 126 | Graham Holdings Company (education and media organization) (2011-present); and formerly, The Southern Company (energy company) (2014-May 2020; previously 2010-2012), Cbeyond, Inc. (business communications provider) (2010-2012). |

|

Principal Occupation During at Least the Past 5 Years: |

Director of various companies; Counsel, Finch McCranie, LLP (law firm) (2015-present); John A. Sibley Professor of Corporate and Business Law, University of Georgia School of Law (2015-present; previously 2011-2012); and formerly, Independent Compliance Monitor and Auditor, Volkswagen AG (manufacturer of automobiles and commercial vehicles) (2017-September 2020); Executive Vice President - Government Affairs, General Counsel and Corporate Secretary, PepsiCo, Inc. (consumer products) (2012-2014); Senior Vice President - Government Affairs, General Counsel and Secretary, PepsiCo, Inc. (2004-2011); Senior Fellow of The Brookings Institution (2003-2004); Visiting Professor, University of Georgia School of Law (2004); and Deputy Attorney General, U.S. Department of Justice (2001-2003). |

Robert E. Wade (1946)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 2006 | 30 | El Oro Ltd (investments) (2003- 2019). |

|

Principal Occupation During at Least the Past 5 Years: |

Attorney at law engaged in private practice as a sole practitioner (1972-2008) and member of various boards. |

Independent Trustees serving until 2023 Annual Meeting of Shareholders: |

Name, Year of Birth and Address | Position | Length of

Time Served | Number of Portfolios in

Franklin

Templeton

Fund Complex

Overseen

by Trustee* | Other Directorships Held During

at Least the Past Five Years |

Harris J. Ashton (1932)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 1992 | 135126

| Bar-S Foods (meat packing company) (1981–2010)(1981-2010). |

| |

Principal Occupation During at Least the Past 5 Years: |

Director of various companies; and formerly, Director, RBC Holdings, Inc. (bank holding company) (until 2002); and President, Chief Executive Officer and Chairman of the Board, General Host Corporation (nursery and craft centers) (until 1998). |

Mary C. Choksi (1950)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 2016 | 135126

| Avis Budget Group Inc. (car rental) (2007–present), Omnicom Group Inc. (advertising and marketing communications services) (2011–present)(2011-present) and White Mountains Insurance Group, Ltd. (holding company) (2017–present)(2017-present); and formerly, Avis Budget Group Inc. (car rental) (2007-May 2020).

|

| |

Principal Occupation During at Least the Past 5 Years: |

Director of various companies; and formerly,, Founder and Senior Advisor, Strategic Investment Group (investment management group) (2015–2017)(2015-2017); Founding Partner and Senior Managing Director, Strategic Investment Group (1987–2015)(1987-2015); Founding Partner and Managing Director, Emerging Markets Management LLC (investment management firm) (1987–2011)(1987-2011); and Loan Officer/Senior Loan Officer/Senior Pension Investment Officer, World Bank Group (international financial institution) (1977–1987)(1977-1987). |

| | | | 4/5 | | | | |

Name, Year of Birth and Address | Position | Length of

Time Served | Number of Portfolios in

Franklin

Templeton

Fund Complex

Overseen

by Trustee* | Other Directorships Held During

at Least the Past Five Years |

Edith E. Holiday (1952)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Lead

Independent

Trustee | Trustee since 1996 and Lead Independent Trustee since 2007 | 135126

| Hess Corporation (exploration of oil and gas) (1993–present)(1993-present), Canadian National Railway (railroad) (2001–present)(2001-present), White Mountains Insurance Group, Ltd. (holding company) (2004–present)(2004-present), Santander Consumer USA Holdings, Inc. (consumer finance) (2016–present)(2016-present); Santander Holdings USA. (holding company) (2019-present); and formerly, RTI International Metals, Inc. (manufacture and distribution of titanium) (1999–2015)(1999-2015) and H.J. Heinz Company (processed foods and allied products) (1994–2013)(1994-2013). |

| |

Principal Occupation During at Least the Past 5 Years: |

Director or Trustee of various companies and trusts; and formerly, Assistant to the President of the United States and Secretary of the Cabinet (1990–1993)(1990-1993); General Counsel to the United States Treasury Department (1989–1990)(1989-1990); and Counselor to the Secretary and Assistant Secretary for Public Affairs and Public Liaison-United States Treasury Department (1988–1989)(1988-1989). |

J. Michael Luttig (1954)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 2009 | 135126

| Boeing Capital Corporation (aircraft financing) (2006–2013)(2006-2010). |

| |

Principal Occupation During at Least the Past 5 Years: |

Executive Vice President,Private investor; and formerly, Counselor and Senior Advisor to Boeingthe Chairman, CEO, and Board of Directors, of The Boeing Company (aerospace company), and member of the Executive Council (May 2019)2019-January 1, 2020); and formerly,Executive Vice President, General Counsel and member of the Executive Council, The Boeing Company (2006–2019)(2006-2019); and Federal Appeals Court Judge, U.S.United States Court of Appeals for the Fourth Circuit (1991–2006)(1991-2006).

|

| |

Independent Trustee serving until 2022 Annual Meeting of Shareholders: |

Constantine D. Tseretopoulos (1954)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Trustee | Since 1999 | 2119

| None |

| |

Principal Occupation During at Least the Past 5 Years: |

Physician, Chief of Staff, owner and operator of the Lyford Cay Hospital (1987–present)(1987-present); director of various nonprofit organizations; and formerly,, Cardiology Fellow, University of Maryland (1985–1987)(1985-1987); and Internal Medicine Resident, Greater Baltimore Medical Center (1982–1985)(1982-1985). |

| | | | 6 | | |

Interested Trustees serving until 2022 Annual Meeting of Shareholders: |

Name, Year of Birth and Address | Position | Length of

Time Served | Number of

Portfolios in

Franklin

Templeton

Fund Complex

Overseen

by Trustee* | Other Directorships Held During

at Least the Past Five Years |

**Rupert H. Johnson, Jr. (1940)

One Franklin Parkway

San Mateo, CA 94403-1906 | Chairman of the Board, Trustee and Vice President | Chairman of the Board and Trustee since 2013 and Vice President since 1996 | 135126

| None |

| |

Principal Occupation During at Least the Past 5 Years: |

Vice Chairman, Member—Office of the Chairman and Director (Vice Chairman), Franklin Resources, Inc.; Director, Franklin Advisers, Inc.; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 37 of the investment companies in Franklin Templeton.

|

**Gregory E. Johnson (1961)

One Franklin Parkway

San Mateo, CA 94403-1906 | Trustee | Since 2007 | 147137

| None |

| |

Principal Occupation During at Least the Past 5 Years: |

Executive Chairman, Chairman of the Board Member—Office of the Chairman,and Director, and Chief Executive Officer, Franklin Resources, Inc.; officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 39 of the investment companies in Franklin Templeton; Vice Chairman, Investment Company Institute; and formerly, Chief Executive Officer (2013-2020) and President (1994-2015), Franklin Resources, Inc. (1994–2015). |

Independent Trustees serving until 2021 Annual Meeting of Shareholders:

|

Name, Year of Birth and Address

| Position

| Length of

Time Served

| Number of

Portfolios in

Franklin

Templeton

Fund Complex

Overseen

by Trustee*

| Other Directorships Held During

at Least the Past Five Years

|

Ann Torre Bates (1958)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923

| Trustee

| Since 2008

| 33

| Ares Capital Corporation (specialty finance company) (2010–present), United Natural Foods, Inc. (distributor of natural, organic and specialty foods) (2013–present), Allied Capital Corporation (financial services) (2003–2010), SLM Corporation (Sallie Mae) (1997–2014) and Navient Corporation (loan management, servicing and asset recovery) (2014–2016).

|

|

Principal Occupation During at Least the Past 5 Years:

|

Director of various companies; and formerly, Executive Vice President and Chief Financial Officer, NHP Incorporated (manager of multifamily housing) (1995–1997); and Vice President and Treasurer, US Airways, Inc. (until 1995).

|

David W. Niemiec (1949)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923

| Trustee

| Since 2005

| 33

| Hess Midstream Partners LP (oil and gas midstream infrastructure) (2017–present).

|

|

Principal Occupation During at Least the Past 5 Years:

|

Advisor, Saratoga Partners (private equity fund); and formerly, Managing Director, Saratoga Partners (1998–2001) and SBC Warburg Dillon Read (investment banking) (1997–1998); Vice Chairman, Dillon, Read & Co. Inc. (investment banking) (1991–1997); and Chief Financial Officer, Dillon, Read & Co. Inc. (1982–1997).

|

Name, Year of Birth and Address

| Position

| Length of

Time Served

| Number of

Portfolios in

Franklin

Templeton

Fund Complex

Overseen

by Trustee*

| Other Directorships Held During

at Least the Past Five Years

|

Larry D. Thompson (1945)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923

| Trustee

| Since 2005

| 135

| The Southern Company (energy company) (2014–present; previously 2010–2012), Graham Holdings Company (education and media organization) (2011–present) and Cbeyond, Inc. (business communications provider) (2010–2012).

|

|

Principal Occupation During at Least the Past 5 Years:

|

Director of various companies; Counsel, Finch McCranie, LLP (law firm) (2015–present); Independent Compliance Monitor and Auditor, Volkswagen AG (manufacturer of automobiles and commercial vehicles) (2017–present); John A. Sibley Professor of Corporate and Business Law, University of Georgia School of Law (2015–present; previously 2011–2012); and formerly, Executive Vice President—Government Affairs, General Counsel and Corporate Secretary, PepsiCo, Inc. (consumer products) (2012–2014); Senior Vice President—Government Affairs, General Counsel and Secretary, PepsiCo, Inc. (2004–2011); Senior Fellow of The Brookings Institution (2003–2004); Visiting Professor, University of Georgia School of Law (2004); and Deputy Attorney General, U.S. Department of Justice (2001–2003).

|

Robert E. Wade (1946)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923

| Trustee

| Since 2006

| 33

| El Oro Ltd (investments) (2003–June 2019).

|

|

Principal Occupation During at Least the Past 5 Years:

|

Attorney at law engaged in private practice as a sole practitioner (1972–2008) and member of various boards.

|

* We base the number of portfolios on each separate series of the U.S. registered investment companies within the Franklin Templeton fund complex. These portfolios have a common investment manager or affiliated investment manager, and also may share a common underwriter.

** Rupert H. Johnson, Jr. and Gregory E. Johnson are “interested persons” of the Fund as defined by the 1940 Act. The 1940 Act limits the percentage of interested persons that can comprise a fund’s board of trustees. Rupert H. Johnson, Jr. is considered an interested person of the Fund due to his position as an officer, director and major shareholder of Resources, which is the parent company of the Fund’s investment manager, and his position with the Fund. Gregory E. Johnson is considered an interested person of the Fund due to his position as an officer, director and shareholder of Resources. Rupert H. Johnson, Jr. is the uncle of Gregory E. Johnson. The remaining Trustees of the Fund are Independent Trustees.

The following tables provide the dollar range of equity securities of the Fund and of all U.S. registered funds in the Franklin Templeton fund complex beneficially owned by the Trustees as of December 16, 2019:14, 2020:

| | | |

Independent Trustees: Name of Trustee | Dollar Range of Equity

Securities in the Fund(1) | Aggregate Dollar Range of Equity

Securities in All Funds in the

Franklin Templeton

Fund Complex |

Harris J. Ashton.......................................................................Ashton.................................................................................................. | $1—$10,000 | Over $100,000 |

Ann Torre Bates......................................................................Bates................................................................................................. | $10,001—$50,000 | Over $100,000 |

Mary C. Choksi.......................................................................Choksi.................................................................................................. | None | Over $100,000 |

Edith E. Holiday......................................................................Holiday................................................................................................. | $1—$10,000 | Over $100,000 |

J. Michael Luttig......................................................................Luttig................................................................................................ | $10,001—$50,000 | Over $100,000 |

David W. Niemiec...................................................................Niemiec............................................................................................. | None | Over $100,000 |

Larry D. Thompson.................................................................Thompson........................................................................................... | $10,001—$50,000 | Over $100,000 |

Constantine D. Tseretopoulos.................................................Tseretopoulos.......................................................................... | None | Over $100,000 |

Robert E. Wade.......................................................................Wade.................................................................................................. | None | Over $100,000 |

| | | |

Interested Trustees: Name of Trustee | Dollar Range of Equity

Securities in the Fund(1) | Aggregate Dollar Range of Equity

Securities in All Funds in the

Franklin Templeton

Fund Complex |

Rupert H. Johnson, Jr..............................................................Jr........................................................................................ | None | Over $100,000 |

Gregory E. Johnson.................................................................Johnson........................................................................................... | None | Over $100,000 |

(1) Dollar range based on NYSE closing price on December 16, 2019.14, 2020.

How often do the Trustees meet and what are they paid?

The role of the Trustees is to provide general oversight of the Fund’s business and to ensure that the Fund is operated for the benefit of all of the Fund’s shareholders. The Trustees anticipate meeting at least five times during the current fiscal year to review the operations of the Fund and the Fund’s investment performance, and will meet more frequently as necessary. The Trustees also oversee the services furnished to the Fund by Templeton Asset Management Ltd., the Fund’s investment manager (the “Investment Manager” or “TAML”), and various other service providers.

The Fund’s Independent Trustees constitute the sole independent Board members of 12 investment companies in the Franklin Templeton fund complex. As of January 1, 2018, each Independent Trustee is paid a $245,000 annual retainer fee, together with a $7,000 per meeting fee for attendance at each regularly scheduled Board meeting, a portion of which fees are allocated to the Fund. To the extent held, compensation also may be paid for attendance at specially called Board meetings. The Fund’s Lead Independent Trustee is paid an annual supplemental retainer of $50,000 for service to such investment companies, a portion of which is allocated to the Fund. Board members who serve on the Audit Committee of the Fund and such other investment companies receive a $10,000 annual retainer fee, together with a $3,000 fee per Audit Committee meeting attended, a portion of which is allocated to the Fund. David W. Niemiec, who serves as Chairman of the Audit Committee of the Fund and such other investment companies, receives an additional $15,000, for a total retainer fee of $25,000 per year, a portion of which is allocated to the Fund.

During the fiscal year ended August 31, 2019,2020, there were five meetings of the Board, fivesix meetings of the Audit Committee, and two meetings of the Nominating Committee. Each Trustee then in office attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which the Trustee served. The Fund does not currently have a formal policy regarding Trustees’ attendance at the annual shareholders’ meeting. No Trustees attended the Fund’s last annual meeting held on March 4, 2019.2, 2020.

Independent Trustees are also reimbursed for expenses incurred in connection with attending Board meetings. The Interested Trustees and certain officers of the Fund who are shareholders of Resources are not compensated by the Fund for their services, but may receive indirect remuneration due to their participation in management fees and other fees received by the Investment Manager and its affiliates from the funds in Franklin Templeton. The Investment Manager or its affiliates pay the salaries and expenses of the officers and the Interested Trustees. No pension or retirement benefits are accrued as part of Fund expenses.

The table below indicates the total fees paid to the Independent Trustees by the Fund individually and by all of the funds in the Franklin Templeton fund complex. These Trustees also serve as directors or trustees of other funds in Franklin Templeton, many of which hold meetings at different dates and times. The Trustees and the Fund’s management believe that having the same individuals serving on the boards of multiple funds in Franklin Templeton enhances the ability of each fund to obtain, at a relatively modest cost to each separate fund, the services of high caliber, experienced and knowledgeable Independent Trustees who can bring their experience and talents to, and effectively oversee the management of, several funds.

Name of Trustee | Aggregate

Compensation from the Fund(1) | Total Compensation from

Franklin Templeton

Fund Complex(2) | Number of Boards within

Franklin Templeton

Fund Complex

on which Trustee Serves(3) |

Harris J. Ashton.................................................... | $ 3,956 | $ 642,000 | 36 |

Ann Torre Bates(4)................................................. | 4,132 | 610,000 | 15 |

Mary C. Choksi..................................................... | 4,026 | 688,000 | 36 |

Edith E. Holiday................................................... | 4,212 | 757,111 | 36 |

J. Michael Luttig................................................... | 4,126 | 713,000 | 36 |

David W. Niemiec................................................ | 4,187 | 610,000 | 15 |

Larry D. Thompson.............................................. | 4,026 | 688,000 | 36 |

Constantine D. Tseretopoulos.............................. | 4,132 | 308,000 | 12 |

Robert E. Wade(4).................................................. | 4,026 | 651,000 | 15 |

Name of Trustee | Aggregate

Compensation from the Fund(1) | Total Compensation from

Franklin Templeton

Fund Complex(2) | Number of Boards within

Franklin Templeton

Fund Complex

on which Trustee Serves(3) |

Harris J. Ashton............................................................................. | $4,141 | $640,000 | 36 |

Ann Torre Bates(4)......................................................................... | $4,345 | $664,313 | 15 |

Mary C. Choksi............................................................................. | $4,213 | $680,000 | 36 |

Edith E. Holiday............................................................................ | $4,445 | $770,000 | 36 |

J. Michael Luttig........................................................................... | $4,345 | $705,000 | 36 |

David W. Niemiec........................................................................ | $4,414 | $615,687 | 15 |

Larry D. Thompson...................................................................... | $4,213 | $680,000 | 36 |

Constantine D. Tseretopoulos..................................................... | $4,345 | $308,000 | 12 |

Robert E. Wade(4).......................................................................... | $4,213 | $597,000 | 15 |

(1) Compensation received for the fiscal year ended August 31, 2019.2020.

(2) Compensation received for the 12 months ended September 30, 2019.2020.

(3) We base the number of boards on the number of U.S. registered investment companies in the Franklin Templeton fund complex. This number does not include the total number of series or funds within each investment company for which the Board members are responsible. Franklin Templeton currently includes 4144 U.S. registered investment companies, with approximately 187189 U.S. based funds or series.

(4) Ms. Bates and Mr. Wade also are independent trustees of Franklin Mutual Series Funds and may, in the future, receive payments pursuant to a discontinued retirement plan that generally provides payments to independent board members who have served seven years or longer for such fund.

Board members historically have followed a policy of having substantial investments in one or more of the funds in Franklin Templeton, as is consistent with their individual financial goals. In February 1998, this policy was formalized through adoption of a requirement that each Board member annually invest one-third of the fees received for serving as a director or trustee of a Templeton fund (excluding committee fees) in shares of one or more Templeton funds (which may include the Fund) until the value of such investments equals or exceeds five times the annual retainer and regular Board meeting fees paid to such Board member. Investments in the name of family members or entities controlled by a Board member constitute fund holdings of such Board member for purposes of this policy, and a three-year phase-in period applies to such investment requirements for newly elected Board members. In implementing such policy, a Board member’s fund holdings existing on February 27, 1998, were valued as of such date with subsequent investments valued at cost.

Who are the Executive Officers of the Fund?

Officers of the Fund are appointed by the Trustees and serve at the pleasure of the Board. Listed below, for the Executive Officers, are their names, years of birth and addresses, as well as their positions and length of service with the Fund, and principal occupations during at least the past five years.

Name, Year of Birth and Address | Position | Length of Time Served |

Rupert H. Johnson, Jr. | Chairman of the Board, Trustee and Vice President | Chairman of the Board and Trustee since 2013 and Vice President since 1996 |

| |

Please refer to the table “Interested Trustees serving until 2022 Annual Meeting of Shareholders” for additional information about Mr. Rupert H. Johnson, Jr. |

Alison E. Baur (1964)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President and Assistant Secretary | Since 2012 |

| |

Principal Occupation During at Least the Past 5 Years: |

Deputy General Counsel, Franklin Templeton; and officer of some of the other subsidiaries of Franklin Resources, Inc. andof 41 of the investment companies in Franklin Templeton. |

Breda M. Beckerle (1958)

280 Park Avenue

New York, NY 10017 | Chief Compliance Officer | Since October 2020 |

|

Principal Occupation During at Least the Past 5 Years: |

Chief Compliance Officer, Fiduciary Investment Management International, Inc., Franklin Advisers, Inc., Franklin Advisory Services, LLC, Franklin Mutual Advisers, LLC, Franklin Templeton Institutional, LLC; and officer of 41 of the investment companies in Franklin Templeton. |

Steven J. Gray (1955)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President and Assistant Secretary | Since 2009 |

| |

Principal Occupation During at Least the Past 5 Years: |

Senior Associate General Counsel, Franklin Templeton; Vice President, Franklin Templeton Distributors, Inc. and FASA, LLC; and officer of 41 of the investment companies in Franklin Templeton. |

Matthew T. Hinkle (1971)

One Franklin Parkway

San Mateo, CA 94403-1906 | Chief Executive Officer— Finance and Administration | Since 2017 |

| |

Principal Occupation During at Least the Past 5 Years: |

Senior Vice President, Franklin Templeton Services, LLC; officer of 41 of the investment companies in Franklin Templeton; and formerly,, Vice President, Global Tax (2012–April(2012-April 2017) and Treasurer/Assistant Treasurer, Franklin Templeton (2009–2017)(2009-2017). |

Robert G. Kubilis (1973)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Chief Financial Officer, Chief Accounting Officer and Treasurer | Since 2017 |

| |

Principal Occupation During at Least the Past 5 Years: |

Treasurer, U.S. Fund Administration & Reporting and officer of 15 of the investment companies in Franklin Templeton. |

Robert Lim (1948)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President—AML Compliance | Since 2016 |

| |

Principal Occupation During at Least the Past 5 Years: |

Vice President, Franklin Templeton Companies, LLC; Chief Compliance Officer, Franklin Templeton Distributors, Inc. and Franklin Templeton Investor Services, LLC; and officer of 41 of the investment companies in Franklin Templeton. |

Robert C. Rosselot (1960)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923

| Chief Compliance Officer

| Since 2013

|

|

Principal Occupation During at Least the Past 5 Years:

|

Director, Global Compliance, Franklin Templeton; Vice President, Franklin Templeton Companies, LLC; officer of 41 of the investment companies in Franklin Templeton; and formerly, Senior Associate General Counsel, Franklin Templeton (2007–2013); and Secretary and Vice President, Templeton Group of Funds (2004–2013).

|

Manraj S. Sekhon (1969)

7 Temasek Blvd.,

Suntec Tower 1, #38-03,

Singapore 038987 | President and Chief Executive Officer— Investment Management | Since 2018 |

| |

Principal Occupation During at Least the Past 5 Years: |

Chief Investment Officer, Franklin Templeton Emerging Markets Equity; officer of four of the investment companies in Franklin Templeton; and formerly, Chief Executive and Chief Investment Officer, Fullerton Fund Management Company Ltd. (2011–2016)(2011-2016). |

Navid J. Tofigh (1972)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President and Assistant Secretary | Since 2015 |

| |

Principal Occupation During at Least the Past 5 Years: |

Associate General Counsel and officer of 41 of the investment companies in Franklin Templeton. |

Craig S. Tyle (1960)

One Franklin Parkway

San Mateo, CA 94403-1906 | Vice President and Assistant Secretary | Since 2005 |

| |

Principal Occupation During at Least the Past 5 Years: |

General Counsel and Executive Vice President, Franklin Resources, Inc.; and officer of some of the other subsidiaries of Franklin Resources, Inc. and of 41 of the investment companies in Franklin Templeton. |

Lori A. Weber (1964)

300 S.E. 2nd Street

Fort Lauderdale, FL 33301-1923 | Vice President and Secretary | Vice President since 2011 and Secretary since 2013 |

| |

Principal Occupation During at Least the Past 5 Years: |

Senior Associate General Counsel, Franklin Templeton; Assistant Secretary, Franklin Resources, Inc.; Vice President and Secretary, Templeton Investment Counsel, LLC; and officer of 41 of the investment companies in Franklin Templeton. |

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE ELECTION OF EACH

OF THE NOMINEES TO THE BOARD.

PROPOSAL 2: TO APPROVE A NEW SUBADVISORY AGREEMENT WITH FRANKLIN TEMPLETON INVESTMENT MANAGEMENT LIMITED

The Board, on behalf of the Fund, unanimously recommends that shareholders of the Fund vote to approve a new Subadvisory Agreement between TAML, as Investment Manager for the Fund, and FTIML (the “FTIML Subadvisory Agreement”).

Why is FTIML recommended to serve as the Fund’s subadviser?

The purpose of the proposed FTIML Subadvisory Agreement is to allow Andrew Ness to serve as a portfolio manager for the Fund. In April 2017, Chetan Sehgal, CFA, Director of Global Emerging Markets and Small Cap Strategies of Templeton Emerging Markets Group and portfolio manager of TAML, began serving as the sole portfolio manager of the Fund as part of a series of new portfolio manager assignments aimed to align portfolio management teams across fund offerings. Mr. Ness is a seasoned emerging markets equity portfolio manager who joined FT in 2018. Since then, he has jointly managed the FT Global Emerging Markets Strategy across FT’s affiliated entities with Mr. Sehgal. Messrs. Sehgal and Ness are currently co-portfolio managers of the Luxembourg and United Kingdom domiciled vehicles within the FT Global Emerging Markets Equity Strategy, which follow a similar investment process to the Fund. Thus, Management is now seeking to add Mr. Ness as a portfolio manager of the Fund. If the FTIML Subadvisory Agreement is approved, Messrs. Sehgal and Ness would serve as co-lead portfolio managers for the Fund. Because Mr. Ness is an employee of FTIML and not of TAML, the Board is being asked to approve FTIML as a subadviser to the Fund in order to allow Mr. Ness to serve as a portfolio manager for the Fund.

The addition of FTIML as a subadviser to the Fund will have no impact on the amount of investment management fees that are paid by the Fund or Fund shareholders because FTIML’s fees will be deducted from the fees that TAML receives from the Fund. Further shareholder approval would be necessary to increase the management fees that are payable by the Fund, which is not contemplated. The approval of the FTIML Subadvisory Agreement for the Fund will not affect how the Fund is managed or the Fund’s investment goal, principal investment strategies or the principal risks associated with an investment in the Fund.

Additional Information about TAML

TAML, with its principal offices at 7 Temasek Boulevard, Suntec Tower One, #38-03, Singapore 038987, is the Investment Manager for the Fund. TAML is organized as a public company limited by shares incorporated in Singapore, and is registered as an investment adviser with the SEC.

TAML serves as the Fund’s Investment Manager pursuant to an amended and restated investment management agreement dated July 1, 2013, as amended as of May 13, 2020. The Board most recently voted to renew the investment management agreement for the Fund on May 13, 2020. The investment management agreement for the Fund was last submitted to the Fund’s sole initial shareholder on February 28, 2002 in connection with the redomestication of the Fund from a Maryland corporation to a Delaware statutory trust, which was approved by the Fund’s shareholders at a meeting held on August 26, 2002.

For the fiscal year ended August 31, 2020, the amount of investment management fees paid to TAML by the Fund was $3,300,796, after taking account of TAML’s agreement to waive its fees and reduce its fees to reflect reduced services resulting from the Fund’s investment in a Franklin Templeton money fund. Before any such waivers, the Fund’s investment management fees totaled $3,340,721.

TAML is a wholly owned subsidiary of Franklin Templeton Capital Holdings Private Limited, with its principal offices at 7 Temasek Boulevard, #38-03, Suntec Tower One, Singapore, 038987, and an indirect wholly owned subsidiary of Resources. The following table sets forth the name and principal occupation of the principal executive officers and each director of TAML. Unless otherwise noted, the business address of the principal executive officers and each director in the table below is 7 Temasek Boulevard, Suntec Tower One, #38-03, Singapore 038987.

Name and Address | Position | Principal Occupation |

Wai Kwok Wu 17th Floor Chater House 8 Connaught Road Central Hong Kong | Director | Senior Executive Vice President, Senior Managing Director, Deputy Director of Research, Director of Portfolio Administration for Templeton Emerging Markets Group. |

Seh Kuan Lim | Director | Chief Accounting Officer – Asia for Corporate Accounting. |

Manraj Singh Sekhon | Co-Chief Executive

Officer and Director | Chief Investment Officer for Franklin Templeton Emerging Markets Equity Group. |

Dora Seow | Co-Chief Executive

Officer and Director | Country Head, Singapore, Institutional and Wholesale Business for Southeast Asia. |

Tek-Khoan Ong | Director | Senior Executive Vice President, Managing Director and Director of Research for Templeton Emerging Markets Group. |

Additional Information about FTIML

FTIML, with its principal offices at Cannon Place, 78 Cannon Street, London, England EC4N 6HL, is organized as a Private Limited Company in England, and is registered as an investment adviser with the SEC.

FTIML is a wholly owned subsidiary of Franklin Templeton Global Investors Limited, with its principal offices at 5 Morrison Street, Edinburgh, Scotland, EH3 8BH, Scotland, and an indirect wholly owned subsidiary of Resources. The following table sets forth the name and principal occupation of the principal executive officer and each director of FTIML. Unless otherwise noted, the business address of the principal executive officer and each director in the table below is Cannon Place, 78 Cannon Street, London, England EC4N 6HL.

Name and Address | Position | Principal Occupation |

Caroline E. Carroll

| Director | Director of Business Administration, EMEA and India Executives. |

Paul M. Collins 5 Morrison Street

Edinburgh EH3 8BH

Scotland | Director | Senior Vice President, Global Head of Trading & Operations for Multi-Asset Solutions. |

Kathleen M. Davidson 5 Morrison Street

Edinburgh EH3 8BH

Scotland | Director | Chief Administration Officer and Director of International Business Development. |

Martyn C. Gilbey

| Chief Executive Officer and Director | Senior Director & United Kingdom Country Head |

William Jackson 5 Morrison Street

Edinburgh EH3 8BH

Scotland | Director | Senior Vice President, Franklin Templeton Services. |

Gwen L. Shaneyfelt One Franklin Parkway San Mateo, CA 94403 | Director | Senior Vice President - Chief Accounting Officer, Global Accounting & Tax. |

What are the material terms of the FTIML Subadvisory Agreement?

Below is a summary of the material terms of the FTIML Subadvisory Agreement. The following discussion is qualified in its entirety by reference to the form of FTIML Subadvisory Agreement attached as Exhibit B to this proxy statement.

Services. Subject to the overall policies, direction and review of the Board and subject to the instructions and supervision of TAML, FTIML will provide certain investment advisory services with respect to securities and investments and cash equivalents in the Fund.

Subadvisory Fees.Under the FTIML Subadvisory Agreement, TAML would pay FTIML a subadvisory fee of 50% of the “net investment advisory fee” paid by the Fund to TAML. The net investment advisory fee is defined in the FTIML Subadvisory Agreement to equal (i) 96% of an amount equal to the total investment management fee payable to TAML, minus any Fund fees and/or expenses waived and/or reimbursed by TAML, minus (ii) any fees payable by TAML to Franklin Templeton Services, LLC (“FT Services”) for fund administrative services.

Payment of Expenses. During the term of the FTIML Subadvisory Agreement, FTIML will pay all expenses incurred by it in connection with the services to be provided by it under the FTIML Subadvisory Agreement other than the cost of securities (including brokerage commissions, if any) purchased by the Fund.

Brokerage. FTIML may place purchase and sale orders on behalf of the Fund and when, doing so, will seek to obtain the most favorable price and execution available when placing trades for the Fund’s portfolio transactions. The FTIML Subadvisory Agreement recognizes that FTIML may place orders on behalf of the Fund with a broker who charges a commission for that transaction which is in excess of the amount of commissions that another broker would have charged for effecting that transaction, in recognition of the brokerage and research services that such broker provides, in accordance with the Fund’s policies and procedures, the terms of the Fund’s investment management agreement, the Fund’s registration statement, and applicable law.

Limitation of Liability. The FTIML Subadvisory Agreement provides that in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of its obligations or duties under such agreement on the part of FTIML, neither FTIML nor any of its directors, officers, employees or affiliates will be subject to liability to TAML, the Fund, or to any shareholder of the Fund for any error of judgment or mistake of law or any other act or omission in the course of, or connected with, rendering services thereunder or for any losses that may be sustained in the purchase, holding or sale of any security by the Fund.

Continuance. If shareholders of the Fund approve the FTIML Subadvisory Agreement, the FTIML Subadvisory Agreement will continue in effect for two years from the date of its execution, unless earlier terminated. The FTIML Subadvisory Agreement is thereafter renewable annually for successive periods of twelve (12) months by a vote of a majority of the Fund’s Independent Trustees at a meeting called for the purpose of voting on such approval, and either (a) the affirmative vote of a “majority of the outstanding voting securities” of the Fund, which is defined in the 1940 Act, as the lesser of: (A) 67% or more of the voting securities of the Fund present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy; or (B) more than 50% of the outstanding voting securities of the Fund (a “1940 Act Majority Vote”), or (b) a majority of the Board as a whole.

Termination. The FTIML Subadvisory Agreement may be terminated (i) at any time, without payment of any penalty, by the Board upon written notice to TAML and FTIML, or a 1940 Act Majority Vote of the Fund’s shareholders, or (ii) by TAML or FTIML upon not less than sixty (60) days’ written notice to the other party.

What other investment companies are managed or subadvised by FTIML? [To be determined]

Following is a list of funds that are managed or subadvised by FTIML that have investment objectives and strategies similar to the Fund.

Name of

Comparable Fund | Net Assets

of Fund

(in millions)

(as of [3/31/20]) | Annual

Investment Management/ Subadvisory Fee | Investment Management/Subadvisory Fee Waived, Reduced or Compensation Otherwise Reduced? (Yes/No) |

[ ] | $[__] | $[__] | [__] |

What fees were paid by the Fund to affiliates of TAML and FTIML during the most recent fiscal year?

Information regarding the fees paid by the Fund to affiliates of TAML and FTIML during the Fund’s most recently completed fiscal year is provided below, under “ADDITIONAL INFORMATION ABOUT THE FUND.”

What did the Board consider when it approved the FTIML Subadvisory Agreement?

At a meeting held on December 3, 2020 (the “December Board Meeting”), the Board, including a majority of the Independent Trustees, reviewed and approved, and recommended shareholder approval of, the FTIML Subadvisory Agreement between TAML, the Investment Manager, and FTIML, an affiliate of the Investment Manager, for an initial two year period. The Independent Trustees received advice from and met separately with Independent Trustee counsel in considering whether to approve the FTIML Subadvisory Agreement.

The Board reviewed and considered information provided by the Investment Manager at the December Board Meeting with respect to the FTIML Subadvisory Agreement. The Board also reviewed and considered the factors it deemed relevant in approving the FTIML Subadvisory Agreement, including, but not limited to: (i) the nature, extent, and quality of the services to be provided by FTIML; and (ii) the costs of the services to be provided by FTIML. The Board considered that management proposed that the Board approve the FTIML Subadvisory Agreement in order to facilitate certain portfolio management team enhancements. The Board reviewed and also considered the form of FTIML Subadvisory Agreement and the terms of the FTIML Subadvisory Agreement, noting that the terms and conditions of the FTIML Subadvisory Agreement were substantially identical to the terms and conditions of sub-advisory agreements for other FT mutual funds.

In approving the FTIML Subadvisory Agreement, the Board, including a majority of the Independent Trustees, determined that the terms of the FTIML Subadvisory Agreement are fair and reasonable and that the approval of the FTIML Subadvisory Agreement is in the interests of the Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s determination.

Nature, Extent and Quality of Services. The Board reviewed and considered information regarding the nature, extent and quality of investment management services to be provided by FTIML and currently being provided by TAML and its affiliates to the Fund and its shareholders. In particular, with respect to FTIML, the Board took into account that the FTIML Subadvisory Agreement would not affect how the Fund is managed or the Fund’s investment goal, principal investment strategies or principal risks associated with an investment in the Fund. The Board reviewed and considered information regarding the nature, quality and extent of investment subadvisory services to be provided by FTIML to the Fund and its shareholders under the FTIML Subadvisory Agreement; FTIML’s experience as manager of other funds and accounts, including those within the Franklin Templeton organization; the personnel, operations, financial condition, and investment management capabilities, methodologies and resources of FTIML and FTIML’s capabilities, as demonstrated by, among other things, its policies and procedures reasonably designed to prevent violations of the federal securities laws, which had previously been approved by the Board in connection with its oversight of other funds in the FT organization.

The Board also reviewed and considered the benefits provided to Fund shareholders of investing in a fund that is part of the Franklin Templeton family of funds. The Board noted the financial position of Resources, the parent of TAML and FTIML, and its commitment to the mutual fund business as evidenced by its continued introduction of new funds, reassessment of the fund offerings in response to the market environment and project initiatives and capital investments relating to the services provided to the Fund by the Franklin Templeton organization. The Board specifically noted Franklin Templeton’s commitment to enhancing services and controlling costs, as reflected in its recent outsourcing of certain administrative functions, and growth opportunities, as evidenced by its recent acquisition of the Legg Mason companies.

Following consideration of such information, the Board was satisfied with the nature, extent and quality of services to be provided by FTIML to the Fund and its shareholders.

Fund Performance. The Board noted its review and consideration of the performance results of the Fund in connection with the May 2020 annual contract renewal (the “Annual Contract Renewal”) of the Fund’s investment management agreement. The Board recalled its conclusion at that time that the Fund’s performance was satisfactory. The Board also noted the proposed portfolio management team enhancements for the Fund, and determined that, in light of these changes, additional time will be needed to evaluate the effectiveness of management’s actions.

Comparative Fees and Expenses. The Board reviewed and considered information regarding the investment subadvisory fee to be charged by FTIML. The Board noted that the addition of FTIML will have no impact on the amount of management fees that are currently paid by the Fund as FTIML will be paid by the Investment Manager out of the management fee that TAML receives from the Fund. The Board further noted that the allocation of the fee between TAML and FTIML reflected the services to be provided by each. The Board concluded that the proposed investment subadvisory fee is reasonable.

Management Profitability and Economies of Scale. The Board determined that its conclusions regarding profitability and economies of scale reached in connection with the Annual Contract Renewal of the investment management agreement with TAML had not changed as a result of the proposal to approve the FTIML Subadvisory Agreement.

Conclusion. Based on its review, consideration and evaluation of all factors it believed relevant, including the above-described factors and conclusions, the Board unanimously approved the FTIML Subadvisory Agreement for an initial two year period.

THE BOARD UNANIMOUSLY RECOMMENDS A

VOTE “FOR” PROPOSAL 2.

PROPOSAL 3: RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

How are independent auditors selected?

The Board has a standing Audit Committee currently comprised of David W. Niemiec (Chairman), Ann Torre Bates, J. Michael Luttig and Constantine D. Tseretopoulos, all of whom are Independent Trustees and considered to be “independent” as that term is defined by the NYSE’s listing standards. The Audit Committee is responsible for the appointment, compensation and retention of the Fund’s independent registered public accounting firm (“independent auditors”), including evaluating their independence, recommending the selection of the Fund’s independent auditors to the full Board, and meeting with such independent auditors to consider and review matters relating to the Fund’s financial reports and internal controls.

Which independent auditors did the Board select?

The Audit Committee and the Board have selected the firm of PricewaterhouseCoopers LLP (“PwC”) as the independent auditors for the Fund for the current fiscal year. PwC has examined and reported on the fiscal year-end financial statements dated August 31, 2019,2020, and certain related SEC filings. You are being asked to ratify the Board’s selection of PwC for the current fiscal year ending August 31, 2020.2021. Services to be performed by the independent auditors include examining and reporting on the fiscal year-end financial statements of the Fund and certain related filings with the SEC.

The selection of PwC as the independent auditors for the Fund for the fiscal year ending August 31, 2020,2021, was recommended by the Audit Committee and approved by the Board on October 22, 2019.20, 2020. PwC’s reports on the financial statements of the Fund for the fiscal years for which it has served as auditors did not contain an adverse opinion or a disclaimer of opinion, nor were qualified or modified as to uncertainty, audit scope or accounting principles.

The Audit Committee and the Board have been advised by PwC that neither PwC nor any of its members have any material direct or indirect financial interest in the Fund. Representatives of PwC are not expected to be present at the Meeting, but will have the opportunity to make a statement if they wish, and will be available to respond to appropriate questions.

THE BOARD UNANIMOUSLY RECOMMENDS A

VOTE “FOR” PROPOSAL 3.

◆AUDITOR INFORMATION

Audit Fees. The aggregate fees paid to PwC for professional services rendered by PwC for the audit of the Fund’s annual financial statements or for services that are normally provided by PwC in connection with statutory and regulatory filings or engagements were $46,194$50,267 for the fiscal year ended August 31, 2019,2020, and $53,526$46,834 for the fiscal year ended August 31, 2018.2019.

Audit-Related Fees. There were no fees paid to PwC for assurance and related services rendered by PwC to the Fund that are reasonably related to the performance of the audit of the Fund’s financial statements and not reported under “Audit Fees” above for the fiscal years ended August 31, 20192020, and August 31, 2018.2019.

In addition, the Audit Committee pre-approves PwC’s engagement for audit-related services to be provided to the Investment Manager and any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund, which engagements relate directly to the operations and financial reporting of the Fund. For the fiscal years ended August 31, 2019,2020, and August 31, 2018,2019, there were no fees paid to PwC for such services.

Tax Fees. There were no fees paid to PwC for professional services rendered by PwC to the Fund for tax compliance, tax advice and tax planning for the fiscal years ended August 31, 2019,2020, and August 31, 2018.2019.

In addition, the Audit Committee pre-approves PwC’s engagement for tax services to be provided to the Investment Manager and any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund, which engagements relate directly to the operations and financial reporting of the Fund. The aggregate fees paid to PwC for such services were $0 for the fiscal year ended August 31, 2020, and $20,000 for the fiscal year ended August 31, 2019 and $0 for the fiscal year ended August 31, 2018.2019. The services for which these fees were paid included professional fees in connection with tax treatment of equipment lease transactions and professional fees in connection with an Indonesia withholding tax refund claim.

All Other Fees. The aggregate fees paid to PwC for products and services rendered by PwC to the Fund, other than the services reported above, were $0 for the fiscal year ended August 31, 2019,2020, and $113$111 for the fiscal year ended August 31, 2018.2019. The services for which these fees were paid included review of materials provided to the Fundfund Board in connection with the investment management contract renewal process.

In addition, the Audit Committee pre-approves PwC’s engagement for other services to be provided to the Investment Manager and any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund, which engagements relate directly to the operations and financial reporting of the Fund. The aggregate fees paid to PwC for such services were $137,944 for the fiscal year ended August 31, 2020, and $7,700 for the fiscal year ended August 31, 2019 and $7,500 for the fiscal year ended August 31, 2018.2019. The services for which these fees were paid included the issuance of an Auditors’ Certificate for South Korean regulatory shareholder disclosures.disclosures, and valuation services related to a fair value engagement.

Aggregate Non-Audit Fees. The aggregate fees paid to PwC for non-audit services rendered by PwC to the Fund or to the Investment Manager and to any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund were $27,700$137,944 for the fiscal year ended August 31, 2019,2020, and $7,613$27,811 for the fiscal year ended August 31, 2018.2019.

The Audit Committee has considered whether the provision of the non-audit services that were rendered to the Investment Manager and to any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund is compatible with maintaining PwC’s independence.

Audit Committee Pre-Approval Policies and Procedures. As of the date of this proxy statement, the Audit Committee has not adopted written pre-approval policies and procedures within the meaning of Rule 2-01(c)(7)(i) of Regulation S-X. As a result, all suchthe services described above that are subject to Audit Committee pre-approval and provided by PwC must be directly pre-approved by the Audit Committee or by a designated member of the Audit Committee.Committee pursuant to delegated authority.

Audit Committee Charter. The Board has adopted and approved a formal written charter for the Audit Committee which sets forth the Audit Committee’s responsibilities. A copy of the charter is attached as Exhibit BC to this proxy statement.

As required by the charter, the Audit Committee reviewed the Fund’s audited financial statements and met with management, as well as with PwC, the Fund’s independent auditors, to discuss the financial statements.

Audit Committee Report. The Audit Committee received the written disclosures and the letterletter(s) from PwC required by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) regarding PwC’s communications with the Audit Committee concerning independence. The Audit Committee also received the report of PwC regarding the results of their audit. In connection with the Audit Committee’s review of the financial statements and PwC’s report, the members of the Audit Committee discussed with a representative of PwC, PwC’s independence, as well as the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, issued bythe applicable requirements of the PCAOB and the SEC, including, but not limited to, the following: PwC’s responsibilities in accordance with generally accepted auditing standards; PwC’s responsibilities for information prepared by management that accompanies the Fund’s audited financial statements and any procedures performed and the results; the initial selection of, and whether there were any changes in, significant accounting policies or their application; management’s judgments and accounting estimates; whether there were any significant audit adjustments; whether there were any disagreements with management; whether there was any consultation with other accountants; whether there were any major issues discussed with management prior to PwC’s retention; whether the auditors encountered any difficulties in dealing with management in performing the audit; and PwC’s judgments about the quality of the Fund’s accounting principles.